FEMA’s release of revised flood insurance rate maps includes 42 communities in seven states: Florida, Georgia, Louisiana, New York, Oregon, Texas, and Washington. Many flood map updates place homes and buildings in a Special Flood Hazard Area (SFHA), also known as a high-risk flood zone. A flood map reflects a geographic area -not individual property characteristics; determines the price property owners pay for flood coverage, and influences real estate values.

Through its flood hazard mapping program, FEMA (Federal Emergency Management Agency) identifies flood hazards, assesses flood risks and partners with states and communities. Flood hazard mapping is an important part of the National Flood Insurance Program (NFIP) and the basis of the NFIP regulations and flood insurance requirements. Visit FEMA’s website to learn more.

If you own a commercial or residential structure and carry a mortgage in a community that participates in FEMA’s National Flood Insurance Program, your lender may require you to purchase flood insurance. Failure to do so within a year of the effective map date may result in forced placed insurance by the lender. Flood insurance costs range from a few hundred dollars in low-risk zones to several thousands of dollars in high-risk zones.

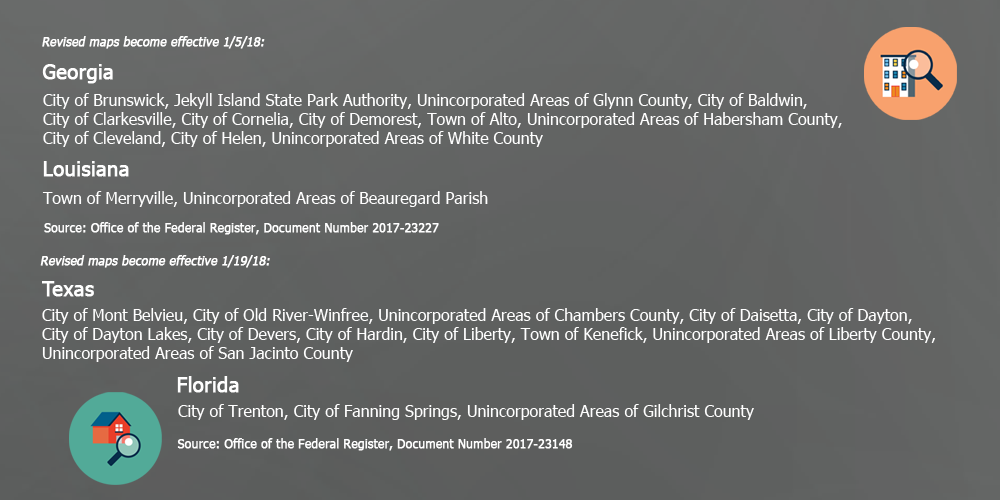

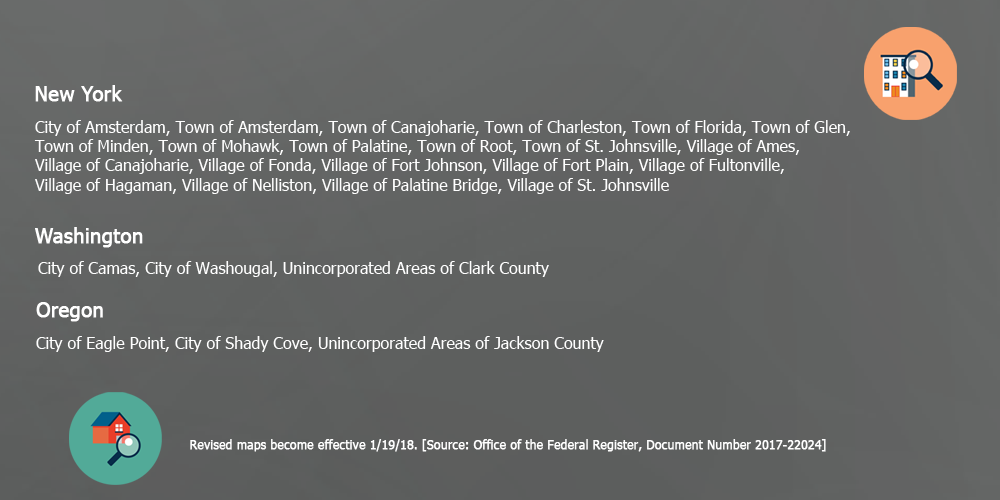

Use the Flood Map Update Tracker below to the learn if your community is on a January 2018 list of revised maps. While the lists only include NFIP participating communities, you can check any location here.

Whether a home or building is in or out of the SFHA, property owners must be proactive. Take advantage of a no-cost flood risk evaluation to learn if your property’s mandatory purchase requirement is justified or if the property qualifies for flood zone reclassification. You have a right to know if the cost of flood coverage is too high, too low, or simply unwarranted.

The flood risk evaluation reviews data and documents relating to an individual structure. It includes an examination of the elevation certificate for errors and omissions that adversely affect the price of coverage. Submit your property for a free flood risk evaluation or simply contact us for more information.