On November 3, 2017, the Federal Emergency Management Agency (FEMA) released revised flood insurance rate maps for select communities in three states: New York, Pennsylvania, and Iowa. The new maps place many homes and buildings in a Special Flood Hazard Area (SFHA), also known as a high-risk flood zone. A flood map reflects a geographic area -not individual property characteristics; determines the price property owners pay for flood coverage, and influences real estate values.

If you own a commercial or residential structure and carry a mortgage in a community that participates in FEMA’s National Flood Insurance Program (NFIP), your lender may require you to purchase flood insurance. Failure to do so within a year of the effective map date may result in forced placed insurance by the lender. Flood insurance costs range from a few hundred dollars in low-risk zones to several thousands of dollars in high-risk zones.

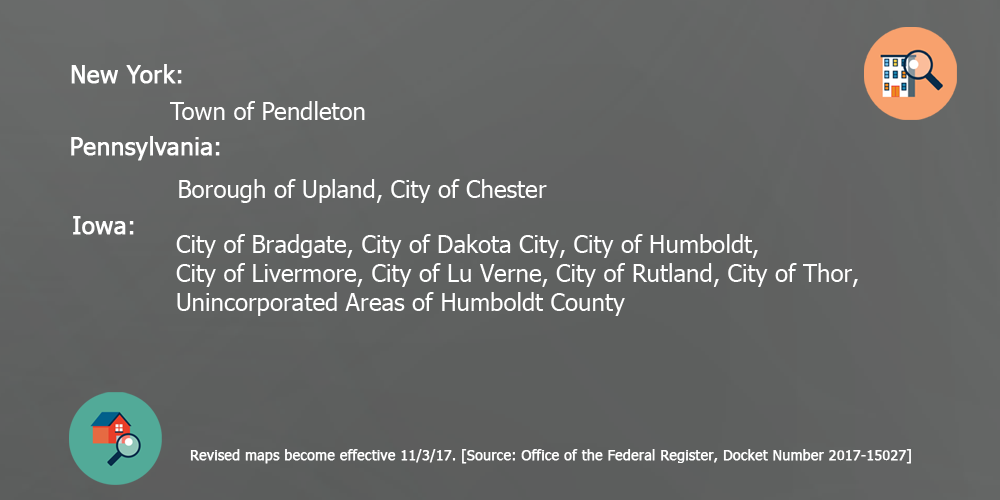

Review the flood map tracking cards below to the learn if your community is on a November 2017 list of revised maps. While the lists only include NFIP participating communities, you can check any location here.

Whether a home or building is in or out of the SFHA, property owners must be proactive. Take advantage of a no-cost flood risk evaluation to learn if your property’s mandatory purchase requirement is justified or if the property qualifies for flood zone reclassification. You have a right to know if the cost of flood coverage is too high, too low, or simply unwarranted.

The flood risk evaluation reviews data and documents relating to an individual structure. It includes an examination of the elevation certificate for errors and omissions that adversely affect the price of coverage. Submit your property for a flood risk evaluation or contact us for more information.