The National Flood Insurance Program (NFIP) requires an elevation certificate to certify the elevation and other characteristics of a building to determine an actuarially sound flood insurance rate. Errors or omissions lead insurance agents to misrate flood insurance policies, resulting in liability for the surveyor, insurance agent, and most importantly, property owner. Because of elevation certificate errors, a property owner can pay too much or too little for flood coverage; and choose to forego coverage when they need it most. An error-free and omission-free elevation certificate enables a broker to make competent recommendations and to write correct flood policies. Accurate data matters, given the critical relationship between elevation certificates and flood insurance rates, as well as, the Federal Emergency Management Agency’s (FEMA) rapid pace of issuing new flood maps that place many low-risk property owners into high-risk flood zones, which require flood insurance if the property carries a mortgage.

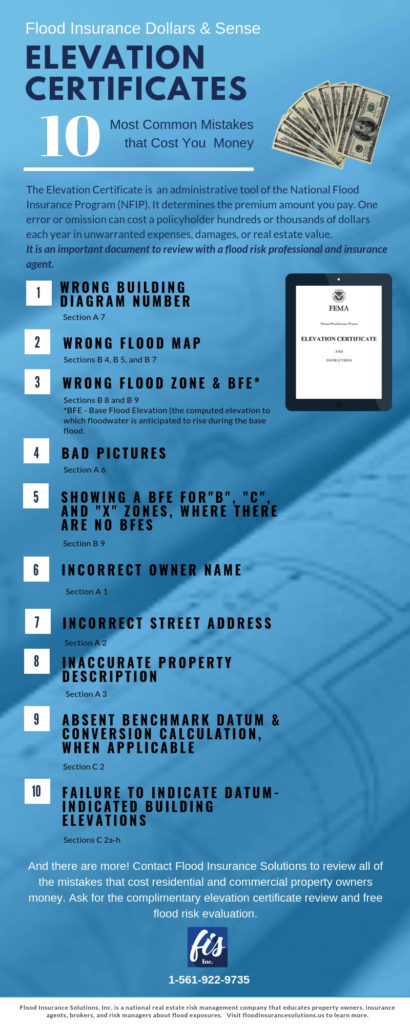

To thoroughly evaluate flood risk and correctly rate buildings for flood coverage, property owners and their insurance agents need quality elevation certificates with accurate data, comprehensive pictures, and detailed notes. The following chart includes ten most common elevation certificate errors that have a substantial impact on a property owner’s protection of assets and the bottom line.

Flood Insurance Solutions, Inc. (FISI) audits existing elevation certificates to identify whether errors or omissions have resulted in improperly rated policies and higher cost of coverage. Over 95 percent of the elevation certificates reviewed by FISI have errors that require surveyor corrections. By uncovering errors and shooting new elevation certificates, FISI clients saved thousands of dollars on flood insurance premiums and created millions of dollars in increased real estate value.

If your property is subject to NFIP requirements, contact FISI for a complimentary elevation certificate review and discuss the document with your insurance agent. This proactive measure will make you a more educated flood insurance consumer.

Is your elevation certificate free of errors and omissions? Have you discussed your elevation certificate with your flood insurance agent? Feel free to submit questions or comments below.